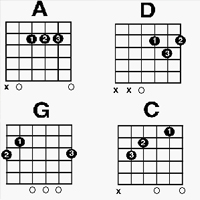

Um zu lernen, die Akkorde einer Gitarre zu lesen, muss man das Basiswissen darüber haben, was ein Akkord ist…

Wenn ich nicht gerade Gitarre spiele, dann treibe ich mich auf der folgenden Website herum 😉 www.realwarstories.com

Aber ich treibe mich auch gern bei Tumblr rum.

Um zu lernen, die Akkorde einer Gitarre zu lesen, muss man das Basiswissen darüber haben, was ein Akkord ist…

Eine Akustikgitarre ist ein Holzinstrument, das wie die Zahl acht geformt ist und an seinem Mittelteil ein Loch hat.…

Mit der konventionellen Art und Weise, wie man eine Akustikgitarre lernt, geschlagen, ohne auch nur eine einzige Melodie zu…

Hast du jemals versucht, das Internet zu nutzen, um Gitarre zu lernen? Nun, wenn du es nicht ausprobiert hast,…

Einige sagen, dass E-Gitarren schwierig zu spielen sind, aber wenn Sie die richtigen Techniken kennen, können Sie lernen, E-Gitarre…

Ist dir bewusst, dass die Bassgitarre das Soul-Instrument der Musik ist? Es gibt dem Lied Leben und wenn Sie…

Es gibt nur 3 wesentliche Elemente, um zu lernen, wie man sich durch den Gitarrenunterricht spielen kann. Zuerst kaufen Sie Ihre eigene Gitarre. Das Ausleihen kann so viel Aufhebens machen, wenn man bedenkt, dass man die Gitarre eines anderen zerstören oder ruinieren könnte. Wenn der Preis nicht das zur Verfügung stehende Geld erreicht, entscheiden Sie sich für etwas Billigeres. Besser noch, du kaufst einen Überschuss. Du könntest viel sparen, wenn du eine gebrauchte Gitarre kaufst. Neben seinem…

Du kannst nicht lernen, ein Musikinstrument zu spielen, wenn du keins besitzt, besonders im Falle einer E-Gitarre. Wenn du also leicht lernen willst, eine E-Gitarre zu spielen, solltest du die perfekte Gitarre für deinen Spielstil finden. Sobald Sie die E-Gitarre gefunden haben, die Sie lieben, können Sie jetzt lernen, sie zu spielen. Im Vergleich zu einer Akustikgitarre sind E-Gitarren viel einfacher zu spielen. Es wäre auch am besten, wenn Sie einen Pick und einen Amp kaufen könnten.…

Denkst du darüber nach, wie man Gitarre lernen kann, ohne einen so großen Betrag an einen Lehrer zu zahlen? Problem gelöst. Dieser Artikel wird beweisen, dass das Erlernen des Spielens und Meisterns einer Gitarre nicht teuer sein muss. Es gibt zwei praktische Möglichkeiten, das Gitarrenspiel zu erlernen. Zuerst wäre es, jemanden zu finden, der alle grundlegenden Dinge kennt. Stellen Sie sicher, dass Sie ihn kennen; einen engen Freund, Klassenkameraden oder Bekannten. Möglich, dein besonderer Jemand. Er sollte…

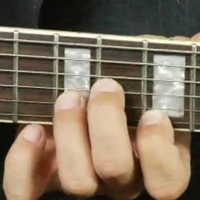

Wenn Sie ein Musikinstrument spielen, müssen Sie lernen, wie man die Noten spielt. Wenn du ein Instrument spielen willst, musst du eines haben, und das gilt besonders, wenn du eine Gitarre spielen willst. Die Noten werden auf dem Griffbrett der Gitarre gespielt. Lerne jetzt Gitarren-Noten zu spielen und auch du kannst das Griffbrett der Gitarre erobern. Du musst keine Angst vor dem Griffbrett haben. Auch wenn es scheint, dass es schwer ist, die Noten zu lernen, wenn…